Cryptocurrency, History, Technology, and Bitcoin

These words are the biggest buzz words in the financial world right now, let’s learn what they are all about

Origin and History

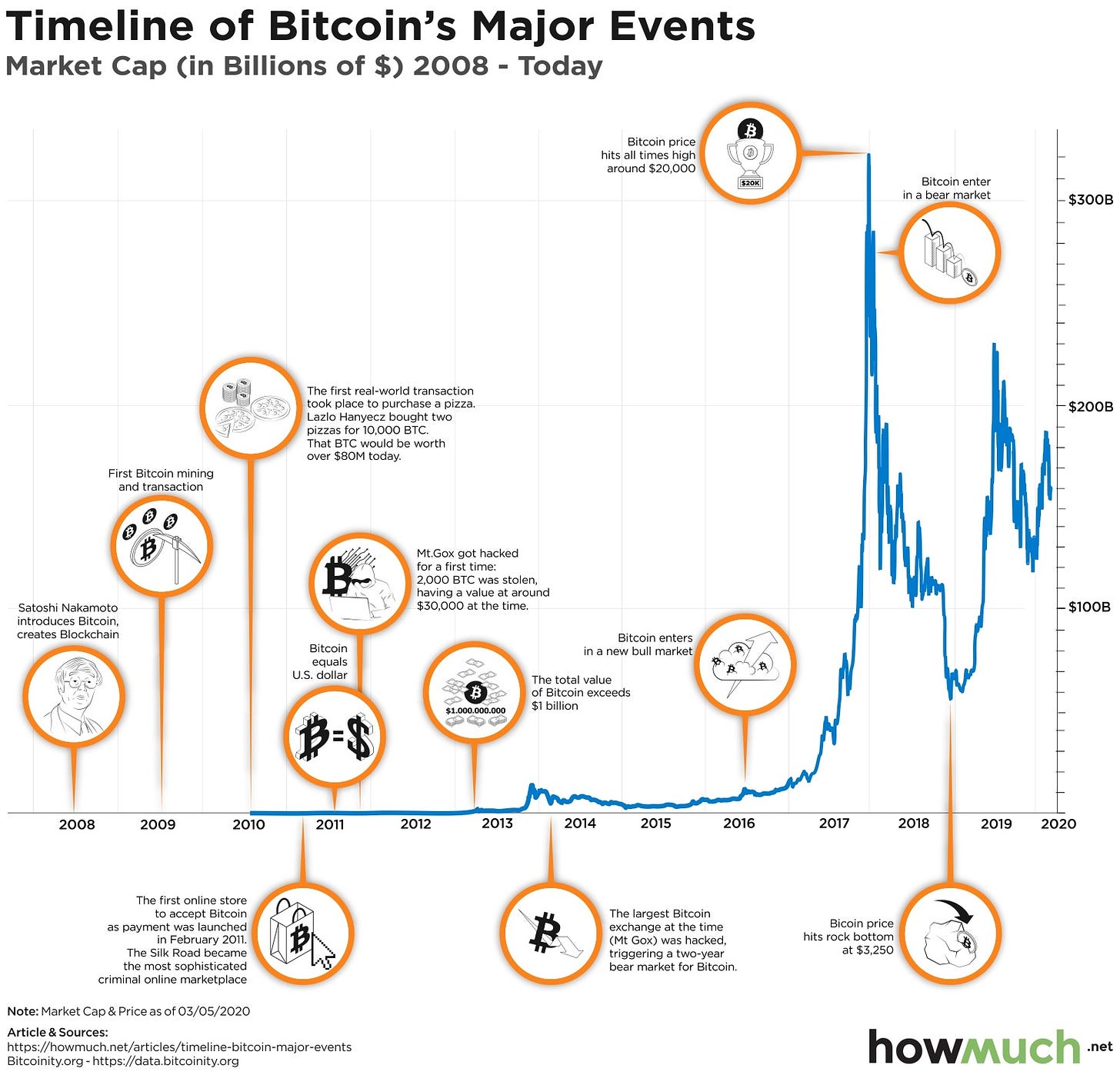

Cryptocurrency, or “crypto” for short, came to exist in the great days after the recession of 2008, Bitcoin being the first ever blockchain-based cryptocurrency launched in 2009. Odd timing, right? I actually could not have picked a better time for Bitcoin to be launched; the financial markets being in a shamble. Nobody trusted the dollar, and nobody knew about Bitcoin...yet.

It took a rather long time for Bitcoin to gain the attention and momentum it has today. However, it grew similar to any other asset would, slowly and at a very consistent rate. By 2017, we saw many other cryptocurrencies were starting to be made, expanding on the concept of a decentralized block chain form of money.

By late 2017 the price of Bitcoin hit all-time highs of around $20,000 per one Bitcoin. This didn’t last long, the price quickly tanked as the volatility was too great and speculation was at an all-time high. Ever since that rise and fall, Bitcoin has slowly risen back up to 20k and even pushed as high as 60k this year. A gradual rise is better for any asset.

Let us take a deeper look into why that all happened, where we are today, and what the future could look like for the crypto market as a whole.

The Technology of Crypto

The engineering behind cryptocurrencies is honestly a work of genius. You would be hard pressed to find someone that does not see the potential of cryptocurrency. However, there are still critics. There were also critics for cars, credit cards, cell phones, microwaves, all the things we now need and love. Keep that in mind before jumping to any rash decisions about cryptocurrency.

Here is the simplest way I can explain what cryptocurrency actually is:

It is a digital currency that is based on a decentralized network using blockchain technology. Blockchain technology is a ledgering system that keeps track of any and all transactions made on the blockchain using crypto. This means there is no central authority such as a bank or government manipulating the changes of this currency.

Sounds good, right? Well, that definition alone has sparked controversy, volatility, and overall opinions about a different future for money.

A good thing to remember is a lot of the alternative coins out there, or “alt coins” for short, may have similar aspects of Bitcoin’s model, but none are as true as Bitcoin. The creator (or creators – we don’t even know) of Bitcoin haven’t even gone public, which adds to the decentralized narrative.

Now, new technology has benefits and negatives, so let’s talk about both. I think it is relevant for me to say that I do have money invested in Bitcoin, but that will not change the fact that there are definitely red flags, as there are in most things in this world. Identifying and acknowledging what those are will help you as an investor and member of society to make your own opinions on crypto and Bitcoin.

Positives and Advantages

The Market Never Closes

Have you always wondered why the stock market is only open for a few hours every weekday? That is because it is regulated by the government. Bitcoin, and now the rest of the crypto space, you do not have to worry about that as the markets are always open. Giving you, the investor or consumer of bitcoin, constant access to your money. This is a big deal but can be overlooked since we have lived with limited access to our investments for so long up to this point.

You Can Print More Dollars, But You Can’t Print More Bitcoin

Right now, the government is printing millions of dollars and flooding the market with this influx of cash. What does that mean? To put it bluntly, the $20 in your in pocket is losing value each and every day. We are all aware of inflation, but do not always realize it is affecting us and our money. Bitcoin, however, solves that problem. There can only be 21 million Bitcoin to ever exist based on the code behind the currency. This creates a limited supply and scarcity value, all of which is important for a currency to have so that its value cannot be controlled by an external force (*cough* the government *cough*).

Bitcoin is Becoming Easier to Use

Why did it shoot up to 20k in 2017? That was all speculation. Why is it shooting up now? Well, that is because it is becoming more widely adopted.

It is going mainstream and big money is buying it up now. Companies listed on the S & P 500 are making purchases of Bitcoin as a store of value. Other companies are adopting the ability to pay for products with Bitcoin. This is the key difference between what Bitcoin was in 2017 and what it is today.

The use of Bitcoin in everyday life is exactly what this currency needs to keep gaining traction. The word Bitcoin isn’t so foreign to everyone nowadays.

No More Third Party

Everything we do goes through a centralized third party. Bitcoin is set up in a way that is focused on peer-to-peer exchanges, giving you security over your own money. This also gives you discretion when it comes to your data and money. Discretion is hard to come by nowadays since the big tech companies sell data for a profit. Bitcoin helps give you some of that power back.

These are just a few of the main reasons why Bitcoin has unlimited potential. This list is not as extensive as it could be because if it were, we would be here all day. This article is a starting point for everyone to use and to then continue their research on their own for more information.

With that being said, we should discuss the negatives of Bitcoin. Just as a friendly reminder, the current system of currency we use has a ton of negatives as well. I will leave that conversation for another day, or another newsletter.

Negatives/Disadvantages

Volatility

This first disadvantage is pretty obvious. The volatility of Bitcoin and all the cryptos is tough to watch and be apart of. That is only the case if you are not backed by data. People use Bitcoin as a “get rich quick” tool when it should not be that way. It is commonly forgotten, though, that all new ventures tend to be treated that way. Scams plague all industries, so it is not surprising that it has latched on to a very new currency like Bitcoin and its overall growth and impact.

As time goes on, however, Bitcoin’s volatility will decrease, so keep that in mind if you are currently invested.

Still Becoming Mainstream

Currencies do not appear out of thin air and get adopted overnight. They take time and willing participants. That is what we are seeing with Bitcoin. The biggest argument against it is people don’t know how to use it in their everyday life. That is a valid concern, but you can see how businesses have started adopting it as a store of value already. That is how every currency has to start. Store of value leads to adoption in everyday things. You can go out and find people that will accept your bitcoin as a transaction on any kind of purchase. For crying out loud, Elon Musk has said he will allow people to buy Teslas with Bitcoin.

There was not one day where all of the sudden, every single corporate office in the world just had Mac monitors for every single employee. The mainstream use of computers started with a handful of visionary people who helped grow the momentum to a full-scale adoption. This process can take years, even decades. So, everyone, slow your roll on the whole, “you can’t even use it!” argument.

Alternative Coins (AKA. Alt coins)

Similar to how Apple will always have competition for the best computer to exist, so does Bitcoin. Competition, I would argue, is a good thing. This is what a free market is all about and gives the best likelihood of finding out the best process for any given industry.

The alt coins that have been popping up by the dozens every month, however, do not have the same features of a Bitcoin. They are actually drifting back to the centralized narrative. This is why, in my incredibly educated opinion, I think if any crypto will work, it will be Bitcoin because it is not controlled by any specific company.

However, we have seen what Doge Coin can do to disrupt the market, so alt coins have definitely cemented themselves as a negative to the overall picture for the crypto space.

Potential Regulations

Bitcoin cannot be shut down by the government. Those are not the regulation concerns I am talking about. I am talking about how governments could stunt the implementation process of Bitcoin, causing the adoption process to take longer or even banning the use of cryptos. We do not see this in the US so far, but countries like China and Russia are drifting in that direction. This will always affect Bitcoin, but also can show how powerful this new currency can really be. If the government is afraid of it, that is saying something - loudly.

This is Only the Beginning

Cryptocurrency is still so new. The fundamentals of this technology are very interesting and fun to learn about. I am not saying this is the end-all be-all of currency. I am saying we should always be exploring every option. In my opinion, Bitcoin is one of the most interesting options. It challenges what we have become so accustomed to, and that is always healthy for an economy.

This article was not meant to be a technical analysis of Bitcoin, but instead just an overview, to get the conversation going, and to motivate everyone to learn more. If you have opinions about Bitcoin, please share it in the comments!

I hope everyone enjoyed this article, especially if you are new to the cryptocurrency marketplace!

Extra Resources

Below are links to numerous resources you can use to learn more about Bitcoin! There is a ton out there so don’t be shy to explore, learn, and form your thoughts and opinions about the future of our world’s currency.

Explanation of the importance of Blockchain technology video

The Original Bitcoin Whitepaper

Explained: Cryptocurrency Netflix Episode

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August! We are already up to 198 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.