I Challenge Everyone to Start Budgeting Their Money. Here is How to Begin!

Budgeting is a key element to achieve financial growth

What is Budgeting?

The first question we must answer is, what in fact is budgeting? Budgeting is the allocation of funds to specific areas of your life. We all have an income that we then disperse into many different fields of our lives. To lump it all into a finite word, let’s call those specific areas of life, expenses.

Expenses are the things you pay for month to month that can range from rent to dining out. We all have varying types of expenses and that is why budgeting is a great way to gain a better understanding of how you spend your money.

In this article I am going to break down how you can take a simple excel sheet and turn it into your financial budgeting planner for everyday use. Seriously, guys, this will take maybe ten minutes and then you are good to go for tracking your money for the rest of your life. Just do it.

This process may raise some eyebrows as you go through and manage your money. You will either be shocked at how much you are spending or be very impressed with yourself on how much you are saving. Either way, it is time to put on your big-kid pants and take a hard look at yourself.

Setting up a Spreadsheet

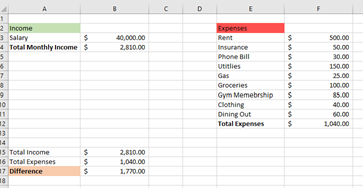

When you start setting up your budgeting template, you will want to cover three sections: income, expenses, and the difference between the two. Luckily for you, I have created an example of how you can set up this document! I put in random numbers just for the sake of the example so no roasting me for miscalculating what expense numbers would be.

Income

For the income section, calculate what your monthly salary would be based on your state’s taxes and place that below what your yearly salary would be. Tracking money month to month is a good cadence for financial security and growth.

Expenses

When it comes to expenses, this is where everyone will be different. Start a list of everything you pay for each month. There are some expenses such as rent and memberships that will be the exact same dollar amount each month, so there you go, those are done. For expenses such as dining out and utilities that do not have a set value month to month, try and set an average number to start just so you have a general starting point. This section is crucial for you to be honest with yourself. If you are a serial online shopper (like my girlfriend) and you love to buy a new dish towel for every holiday (also like my girlfriend), allocate enough money in your “fun stuff” funds for the lifestyle you know you live. Being able to see the whole picture is very important, as then you can start cutting down on things you either do not need or should not be buying so regularly (like a new dish towel for St. Patrick’s Day).

Difference

Once you have your income and expenses calculated, include a section calculating the difference to see how much money you have left over after all is said and done. This money is going straight into savings, investments, or towards something you really need.

Defining your Net Worth

Everyone has a net worth, and everyone should be calculating theirs monthly. Why? Because this will give you the full picture on whether your budgeting, investments, and assets are paying off, or if they are hurting you. Create another page in the excel spreadsheet looking something like this:

How to Calculate your Net Worth

All you need to do is use this simple formula:

Assets – Liabilities = Net Worth

Examples of Assets:

Bank accounts

Investment Accounts

Cash

Retirement Accounts

Examples of Liabilities:

Mortgage

Student Loans

Car Loans

Credit Card Debt

Budget and Net Worth Benefits

The great thing about setting up each of those trackers is you can now see a zoomed-out version of your life and expenses. Most importantly, you will be able to see whether you are trending upwards or downwards (hint: you do not want to be trending downwards). Humans are visual creatures, and this will give you an actual monthly picture of how you are doing rather than guessing or being completely in the dark.

Once you calculate your net worth for the month, you can then go back to your budget and adjust accordingly to what your goals are. This is important stuff, people! Being responsible for your own life and your own funds is one of the most valuable skills a person can have. So, now that you are done reading this newsletter, get out of bed and figure out what your financial situation looks like.

Featured

This week we have another great collaboration with great newsletters! Check it out below and subscribe!

International Intrigue

International Intrigue is a weekly newsletter written by two former diplomats. They scour the world to bring you the foreign affairs stories you might have missed, and why they matter to you. They write in an optimistically contrarian way, with plenty of humor sprinkled in! Check it out!

HOV Access

HOV Access hits your inbox 2x a month to bring you a high level overview of the startup ecosystem. Access has specially curated newsworthy reports, relevant advice, inspirational stories, virtual conferences and more. If you're looking for insights into business building, sign up!

Subscribe: https://www.hov.co/access

Latest Issue: https://www.hov.co/newsletter/issue-3

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August! We are already up to 162 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.