The Most Basic Investing Strategy for Beginners and Passive Investors

Want to invest but keep it as simple as possible? This method could be the best route for you

Welcome to the 4 new “In-Between‘s” who have joined us since last time! Join the 579 others by subscribing here if you haven’t already 📩

If you are already a subscriber, consider upgrading your subscription to paid to support the In-Between ✏️

Investing Can Be Daunting

I have said it before and I will say it again, investing can be daunting for many reasons. That, however, should not be the reason you do not invest. Just like anything in life, investing can be as simple or as detailed as you would like it to be.

In this article I am going to breakdown how I started investing in the stock market using what I believe to be the simplest investing strategy for anyone wanting to dip their toes into the market. This is 100% my opinion and not investing advice. This is solely for educational purposes based on my own experiences.

Let’s dive into it!

The Formula

Keeping investing simple starts with a basic formula that you can replicate over and over. Luckily, I have that formula for you below:

Get paid from job → Put percentage into investing account → Buy market tracking ETF → Repeat

Seems simple right? It is! For new investors, however, let me dive more into the detail as that formula sounds great, but I know those steps still might be confusing. Let me tell you, when I started investing, it was a lot of reading articles and watching YouTube videos to make sense of it all.

Your Job & Investing Percentage

This first step is determining the amount you can invest based on your paychecks.

I have written multiple articles about budgeting and creating a tracking sheet for yourself to better understand what money you can put elsewhere like investing. Check them out below for this step!

The great thing about investing is you do not need tens of thousands of dollars to start investing, it can be as simple as $10 every paycheck. Make sure to do research on which brokerage accounts are the best for your financial goals. The link below is to an article breaking down the benefits of various platforms:

The Best Online Stockbrokers for 2023 - Motley Fool Service

Market Tracking ETF

What the heck is a market tracking ETF? I know, I know, you probably thought I was just going to say, “invest in Apple,” or something like that. Investing in a market tracking ETF you are not only investing in companies like Apple, but all of the major stocks in the stock market.

The most popular / largest traded market index ETF:

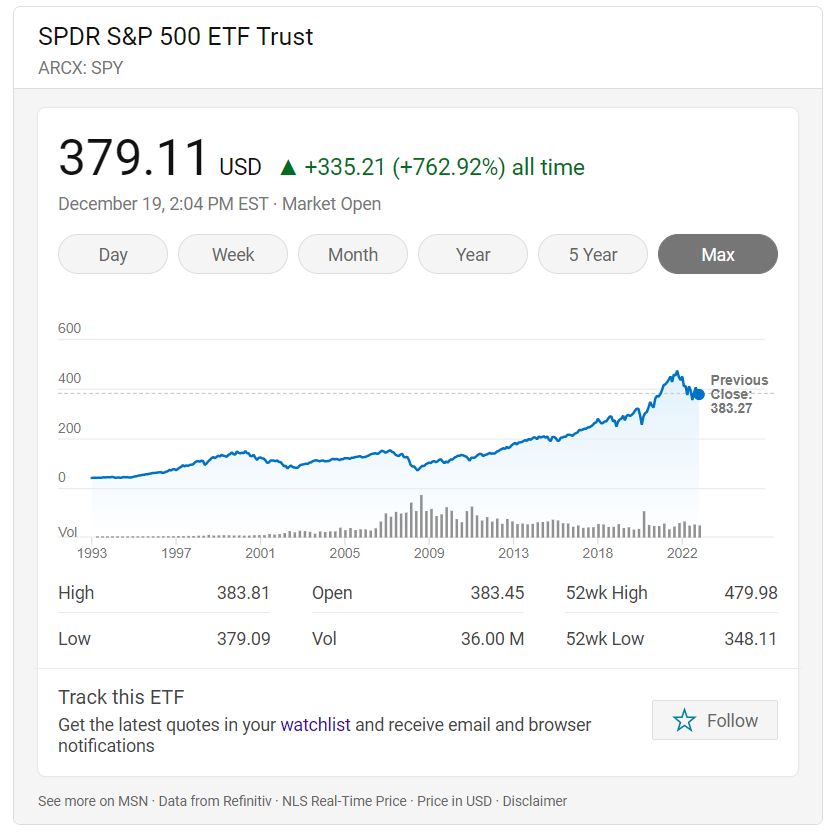

SPDR S&P 500 Trust ETF or ticker symbol “SPY’ for short

This ETF tracks the composition and performance of the S&P 500 stocks which are the top 500 traded companies in the US.

So, in layman’s terms you are buying 500 companies averages with this one ETF stock.

Spreading yourself truly across a wide range of sectors and stock categories.

Put It All Together

You now have all the components of the simplest investing strategy!

You have an investing account – check.

You have an amount you are willing to invest – check.

You have a market tracking ETF picked out – check.

Now all you must do is set up re-occurring deposits into your account that is set up to buy that ETF on a repeatable basis. This is called dollar cost averaging.

And just like that you are in the stock market and investing monthly! Now remember, investing is not about playing the short game, but about playing the long game. Look at this chart below of the SPY ETF as it shows the performance history. See how many years are on that chart. That is what it is all about.

Investing is not about getting rich overnight, and many do not/try to fake it by saying they are an online guru.

So just make sure to keep your expectations in check and remember the market is currently in a volatile state.

I highly recommend if you are new to investing, you should start by speaking with a licensed professional that can walk you through the best strategies for your financial goals. This article is just intended to get the wheels spinning in your head that you can invest in the stock market easier than you might think.

And with that, I bid you all adieu.

Cheers!

Connect With Me

If you have not already, connect/follow me on LinkedIn to receive updates about new content, helpful tips and tricks, and small posts detailing the topics I write about on The In-Between. Click the link button below!

I use LinkedIn as my main source for connecting with you all, but also have an Instagram account for those who enjoy that platform more. Follow below!

And as always, like, share, and comment if you enjoyed this article and think someone you know could benefit from this type of content.