The Psychology of Stock Market Cycles

Humans vs. Stock Market, the greatest battle that never ends. Market cycles bring a lot of emotions to investing. Let’s breakdown why avoiding emotions while investing will benefit you.

Welcome to the 12 new “In-Between‘s” who have joined us since last time! Join the 443 others by subscribing here if you haven’t already 📩:

Have you checked out The In-Between Podcast on Apple Podcasts yet? Give it a listen by clicking the button below if you haven’t already 🎙️:

Follow the Instagram page as well for all the latest updates. Join the 295 followers! 📲:

Human Emotions

Humans are very emotional creatures, and we make a lot of big decisions based on our emotions. A lot of those decisions usually have to do with money. Whether it is purchasing, budgeting, or investing, people tend to let their feelings dictate their financial decisions. We are going to break down the psychology of stock market cycles and how we react to the markets and our personal investments.

Did you know there have been five, what we would call, “crashes,” in the market, and hundreds of downswings? The market could even be dropping as you read this article.

Basically, what I am saying is that the market cannot possibly only rise. However, for those who take emotion of out their strategy and stick through the downswings, success could be right around the corner.

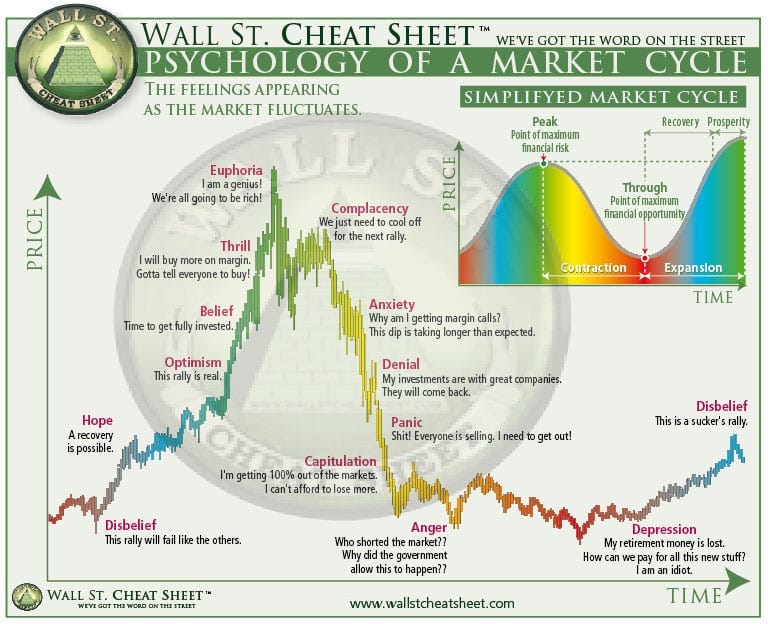

The Wall Street Cheat Sheet

Let’s go ahead and break down that graphic so it is more digestible.

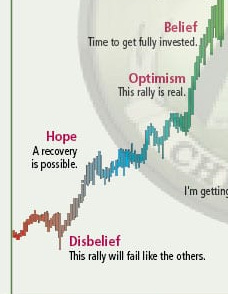

Phase #1: The Rise

I am going to present you with a hypothetical scenario. You just bought a stock, say it is your favorite company, Starbucks. You are new to investing so you are investing in what you know, and what you know is you love a hot cup of joe in the morning. You know thousands of other people love Starbucks too and over a few months you notice the stock rising way higher than you anticipated.

You start saying phrases like, “I knew this stock would start to rise,” and, “I think I like investing.”

This, my friends, is the swan song of Phase 1 of the market cycle. Hope, optimism, and belief fill the air and create a formula that could become destructive if your emotions are not in check for the phases to come.

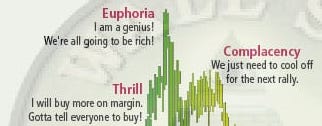

Phase #2: “The stock market is literally free money!”

Welcome to the top of the cycle. Your investment portfolio is on fire and hitting numerous all-time highs. The stock market feels like free money at this point, lol. The problem is that everyone’s investment portfolio is also hitting these same numbers, motivating more people to jump into the market.

You have now entered the overvalued phase. The market numbers are not based on fundamentals and business growth, but now on people’s emotions.

That is where complacency comes in. Do you know what people who do this for a living say when they start to see this trend taking place? It is time to sell!

This is the transition to the next phase. It is about to get messy!

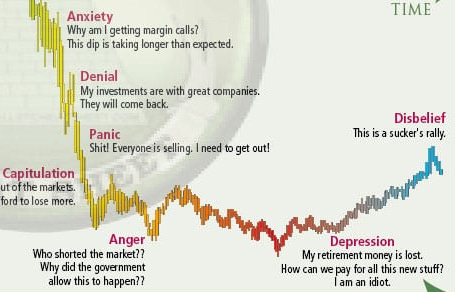

Phase #3: Our Emotions Get the Best of Us

Around this time, people start to catch on that the trend is to get out, sell, move along. So, because that makes you feel (key word: feel, as in feelings as in emotions) like you also need to be selling immediately. A lot of people fall for this trap even if they are invested in fundamentally strong stocks that do not drop as far as the overvalued stocks. We hit the bottom in this phase and anger/depression start to set in.

Most people do not get back into investing or they let this one market cycle completely change their mindset on investing. This is where I begin the part about zooming out and looking at the whole picture.

Ups & Downs

The scenario above has happened hundreds of times in our markets. The problem is, people always forget that since the dawn of the stock market, it has grown to over 5,000 points at its highest, and history tells us it will keep going up with business/economy growth.

The important thing to remember is everything experiences ups and downs, not just the stock market.

Takeaways

Investing strategies can be complicated, but there is one formula that has withstood the test of time. This strategy consists of:

- Buying fundamentally strong stocks/investments

- Holding through the emotional roller-coaster in the markets

- Invest more when the money drops for highest financial possibility

- Sell when it is the best time for you and your financial goals

The market goes through this cycle hundreds of times, sometimes small corrections, and sometimes large crashes. So, the investors that can walk through the fire of the downswings will always turn out better in the end. The chart below shows the S&P 500 all-time growth since inception.

You see that big drop in 2008 because of the housing crisis? Say you invested at the very peak right before the crash. Your portfolio would get destroyed over the coming months. But those that held onto the S&P 500 through the crash without selling would be up a SIGNIFICANT amount today!

Taking it another step further, people who are referred to as having “diamond hands” when the market was dropping would have kept buying S&P 500 stock as the prices became way undervalued.

Not only would their investment at the top still have made them a huge profit today, but that money they invested at the bottom of the market would have made them even more money. Craziness, I know.

You get the picture?

Here is another example from the company nerdwallet.

“Using a common risk assessment tool — called a Monte Carlo simulation — nerdwallet ran 10,000 possible outcomes for investors, based on historical S&P 500 and Treasury returns, and the volatility (riskiness) of those returns.”

The results?

“A 25-year-old earning a starting salary of $40,456 (adjusted annually for inflation) and saving 15% each year has over a 99% chance of maintaining at least their initial investment — the same as a traditional savings account — over 40 years.

Investors also had a 95% chance of earning nearly three times their initial investment, while traditional savers had less than a 3% chance.”

O'Shea, Arielle, and Stephane Lesaffre. "Avoiding the Stock Market May Cost Millennials $3.3 Million." nerdwallet, nerdwallet, www.nerdwallet.com/blog/investing/avoiding-the-stock-market-may-cost-millennials-3-3-million/.

All in All

The point is, once you understand how much the market moves based on our emotions, the more success you will find in your investments. It can seem daunting and difficult, but the most successful investors are always the ones who can step away from all the noise and invest in strong investments.

Cheers!

This is not the only investment strategy and before investing you should always talk to a financial advisor. Everyone has different financial goals. This article is not financial advice.

Newsletter Spotlight

This week we have another great collaboration with a great newsletter! Check it out below and definitely subscribe!

Perceptive Madness by Nia Carnelio

Perceptive Madness is a free newsletter written by Nia, who explores a lesser-known perspective within work and popular culture every week. Each read is full of insight and heart as it breaks down key socio-cultural notions and ideas.

Subscribe below today!