What Factors Impact a Stock Price?

There is no defined science behind stock prices, but there are ways to make sense of it

Common Misconceptions

Knowing why a stock’s price moves up and down is not an exact science. Even the factors discussed in this article will not always follow a pattern or algorithm. A perfect example of this is when a company’s earnings report shows growth, but in turn the stock price decreases. Usually that is the case because the earnings were not as high as expected.

This just shows even the experts might not know whether the stock is going up or down based on any given details.

There are, however, key themes that help the average investor have a sense of why stocks are moving in specific directions. We are going to dive into some of those factors in this article so you can have a solid understanding of what impacts the price of a stock.

1. Positive/Negative News

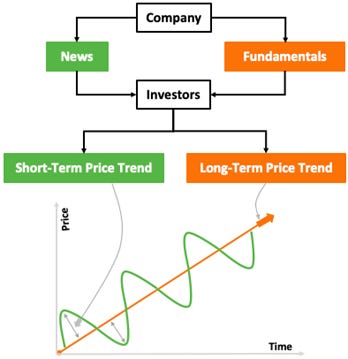

Logically, we are starting with the basics. The factor we all know about. That is, the ability of news, good or bad, affecting the price of a stock. This is referred to as “hype” nowadays. This can range from a news story covered by a national news channel, or even a celebrity (and I use the term celebrity incredibly lightly) tweeting about an insane new stock that is going to the moon.

Whether the news is from big media corporations or from social media, it can have drastic effects on what happens to a stock price moving forward. Usually, this kind of factor is short lived in the price of the stock, but sometimes if the news is big enough it can affect it for many months to come.

This factor tends to play on the emotions of an investor. I have said it in previous articles, if you are a good investor, you will not let media change your overall investing plan. Rather than having “paper hands” in times of bad news, remember your planning and why you bought the stock in the first place and keep those “diamond hands” at work.

*Cough* Unless you strictly invested based on hype or news. *Cough*

If your fundamentals are strong and you are playing the long game of investing, try not to let media sway you off your path. This factor is the most common factor that changes stock prices daily, so remember that, and stay the course.

2. Changes in Staff

A factor many of us consider when buying a company’s stock is the company’s leadership team. Specifically, the C-Suite Team, as they are often addressed (CEO, CFO, CIO, etc.). We research who they are, how they are running the company, and other aspects of their involvement. But why do these positions in the company matter and factor into why a stock price fluctuates?

Well, they are the decision makers, the faces of the company, and have the final decision on the direction of the company.

Choices made by the leaders of a company have the potential to change the opinion of the public on their stock – for the better or for the worse.

When it comes to using this factor to determine whether a stock price will increase or decrease, I would look at these common examples:

- Well-liked CEO steps down = stock price falls

- CEO steps towards new business venture = stock price rises

- C-Suite executives report positive growth = stock price rises

- New CEO hired = stock price might rise or fall depending on the reputation of new hire

These are common examples you will see in the markets, but they do not always trend in this exact direction every time. Make sure you are always doing your research before making a move in the stock market. There are many factors to consider when analyzing your own portfolio, the market as a whole, and specific companies you are interested in.

Because of the uncertainty of the stock market, this is your reminder to always consult a financial representative whenever thinking about investing. Topics discussed in this newsletter are my own opinions and should not be taken as financial advice.

3. Earnings Reports

Buckle up everyone, this is the big one. The factor that has lasting effects on stock prices for months and even years to come.

An earnings report shows the public the growth or lack thereof a company had between each quarter of a business year. This is helpful for investors to know if the company they are invested in is on the right track or if they are slipping in terms of revenue.

You might think these reports are self-explanatory as they relate to the stock price moving up or down. Unfortunately, though, a good earnings report does not always mean the stock price will increase and a bad report does not always mean the price will decrease. There are a few sub-factors that explain why the price will move after a report is published.

Before company earnings reports are released, banks, retail investors, and news corporations will make predictions on what numbers they expect to see. If the numbers come out exactly as predicted or even higher than those predictions, you will probably see a spike in the stock price. But, if the numbers are under those predictions or even worse than last quarters numbers, you are likely to see a sharp change downward in the stock price.

Therein lies the flaw with this factor, it is not cut and dry like you would think (and wish that it was).

These reports will help you see which direction the company is headed and should be treated as check points in your investing journey when it comes to buying and selling your positions.

4. Business Developments

This factor is pretty cut and dry. Why is that? Because when a company focuses on business development and releasing new products, they will most likely boost the business, boost revenue, and therefore boost stock prices. A perfect example is when Apple releases the next generation of the iPhone. That usually comes with new innovative technology and a reason for people to buy the new phone (boosting revenue).

Another key business development strategy is when a company acquires another company. I hope you are kind of getting the idea. Investors love growth, and growth in these ways are usually a good sign of movement on the stock price. There are rare cases when these business ventures do not go as planned and can in turn hurt the revenue and stock price, but we will save that for another newsletter.

Follow your favorite companies and read articles about potential development in their products or purchasing power to have a better understanding of where they are fiscally and what their stock price might be doing in the future.

5. Dividends

For those of you that are not familiar with dividends, think of them as a quarterly bonus you get from the company for owning and holding their stock. Yes, you read that correctly. Some companies will literally pay you money to own their stock. Crazy, right? Usually, the dividend is only a few cents, but can be very valuable if you own a lot of that company’s stock.

Why does this affect the stock price, you might be wondering? There are a few possibilities here. The first is, if a company decides to start paying out dividends to investors, that can be good news and invoke a change in price. Or, even better, the company that already pays out dividends decides to increase the amount they give out to their investors. These two possibilities are usually positives, but their can be negatives in regard to dividends, so pay close attention to what the companies are doing.

Companies can also do the opposite, they can cut the dividend pay out total to a lower amount or worse, cut it all together. Those two possibilities do not usually bode well for the price of the stock. But then again, there is no 100% certainty what the market will do with news like this.

So, keep these in mind when following a stock that pays out a dividend.

Many More Factors

The five factors above are, in my opinion, the biggest factors that determine the price of a stock. However, there are many more factors out there that I will only begin to list out below. As a reminder, there are so many different factors that the best strategy will always remain doing great research and investing for the long term. Getting wrapped up in every little detail might end up hurting your portfolio and bring too much emotion into investing. Smart investing is a perfect balance of research and considerations, and not over-analyzing minor details. I am still mastering this art myself!

Other Factors:

- Supply & Demand

- Political Climate/Changes

- Overall Economy

- Interest Rates/FED

- Hype

- Twitter/Reddit

- Company Competitors

To Conclude

There is so much that goes into investing. Learning the reasons behind things like the price are super important if you want to be a successful and knowledgeable investor. This is just the beginning. There will be many more articles breaking down other important aspects of investing soon. Let me know what you want to read about in the vast world of investing!

Cheers!

Do you follow the Instagram page? Click the link below and follow!

Follow my personal twitter for updates as well!

Twitter Handle: @griffin_prock

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August! We are already up to 235 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.