Welcome to the 9 new “In-Between‘s” who have joined us since last weekend! Join the 364 others by subscribing here if you haven’t already 📩:

Have you checked out The In-Between Podcast on Apple Podcasts yet? Give it a listen by clicking the button below if you haven’t already 🎙️:

The Daunting Side to Investing

I know a lot of people, even myself, can feel hesitant about investing. “It seems like gambling” is a common thought and I understand that concern. But not investing your money is just as risky. That is why the investing apps that exist today are so beneficial to first time investors, like most of us are at this age.

Welcome, Acorns.

In this article I am going to cover what this app does, all the features of the app, and why it is one of my go-to apps for beginning investors.

Before I dive in, this link below is my referral link and if you use this link to sign up and deposit at least $5 into your account you will get $5 free deposited into your account from Acorns just for signing up! I will also link this at the bottom of the article.

Sign up for Acorns: Hey! I'm using Acorns and I love how easy it is to save and invest for my future. Join me and you'll get a free $5 investment! https://share.acorns.com/griffin.prock?advocate.partner_share_id=1515678658524068496

*This offer ends after 9/25

*By the way, this is not a sponsorship. I am writing this article because I use this app and my fiancé (also a beginning investor) uses the app as well and she finds it helpful. Make sure you consult a financial advisor before investing. Everything in this newsletter is my opinion and should not be taken as financial advice.

Acorns

Let’s start with the basics of this application. This is an investing platform in which they promote themselves by reiterating that this is a simple, intuitive app for anybody to feel confident and comfortable investing their money. This does not mean that if you are a pro-investor, you are not allowed to use this app too. It simply means that for the people just trying to learn the ways of the stock market and not feel obligated to check on their money every day, this is the app for you.

Since I began investing, the platform has grown to have debit cards, retirement accounts, and even kids’ investment accounts. For the purposes of this article, however, we are going to stick with its most commonly used service.

What You Are Investing In

This is the most important part! Once you have made an account, they will take you through a series of questions to see what your goals are as an investor. Then, you will be prompted to pick the portfolio that best suits you.

There are five options:

Conservative Portfolio

Moderately Conservative Portfolio

Moderate Portfolio

Moderately Aggressive Portfolio

Aggressive Portfolio

These phrases represent the type of diversification your portfolio will have. As you go up the scale from Conservative to Aggressive you will see a change in how much of your portfolio percentage is in stocks compared to bonds. Choose the one that makes you the most comfortable.

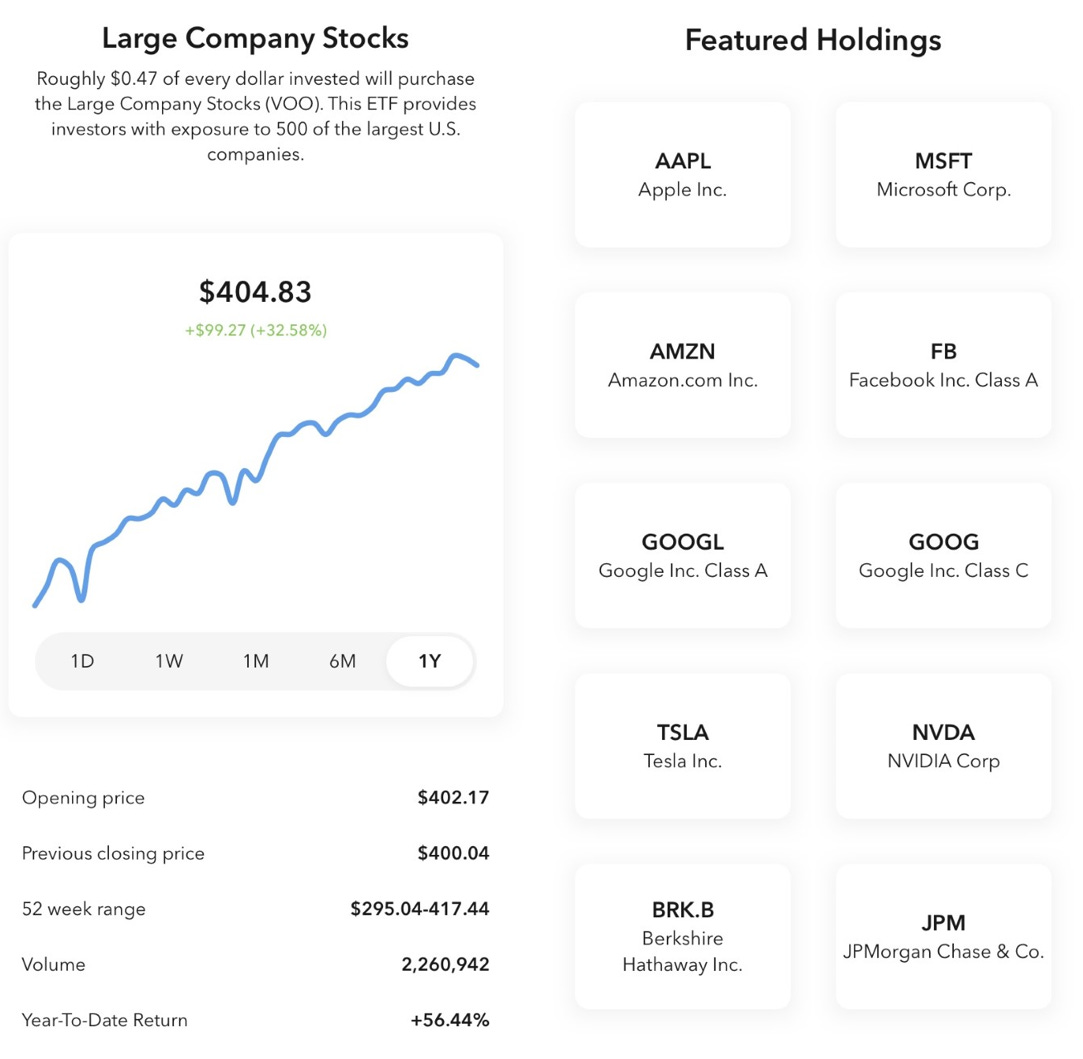

Each of these five types of portfolios is made up of six Exchange Traded Funds, or ETFs. An ETF is a large pool of stocks compiled together so that the average investor like you and me can invest in a wide variety of companies to lower risk and maximize reach in the markets.

For example, the “Large Company Stocks (VOO)” ETF tracks the largest companies in the S & P 500. This includes Google, Microsoft, Facebook, etc.

When you put money into your account, based on the portfolio you chose, you will see how your money was split up amongst the six ETFs in your account.

Oh yeah, and the best part is, you do not need to do anything more after you deposit the money into your account. That’s right! After picking your portfolio, Acorns’ systems will put the money into the account for you. So, you don’t have to do all that “buying and selling” stuff that can get complicated.

Roundups

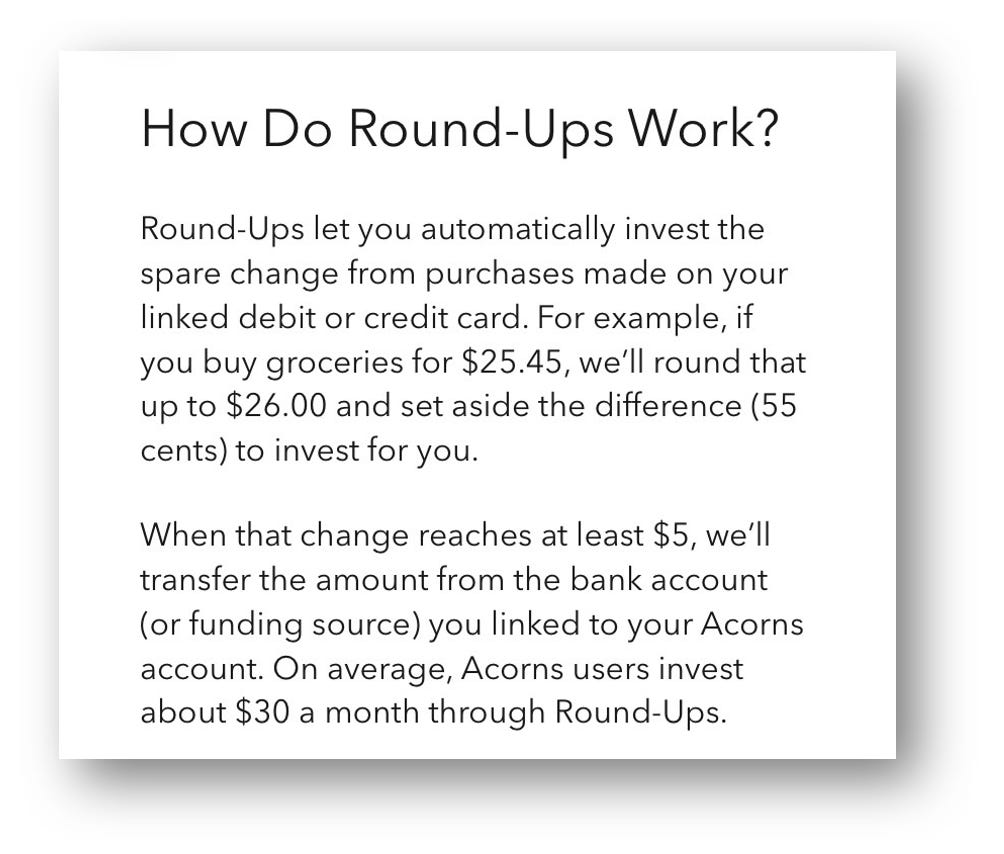

This feature is one of the most notable compared to other investment applications. When you link your debit/credit card to your account, then make a purchase at the grocery store for example, it will take a portion of your spare change and invest it into your Acorns account.

This will help you learn how cool compound interest really is. This also helps you not have to be actively and constantly thinking about your investments, the app has got you covered.

Re-Occurring

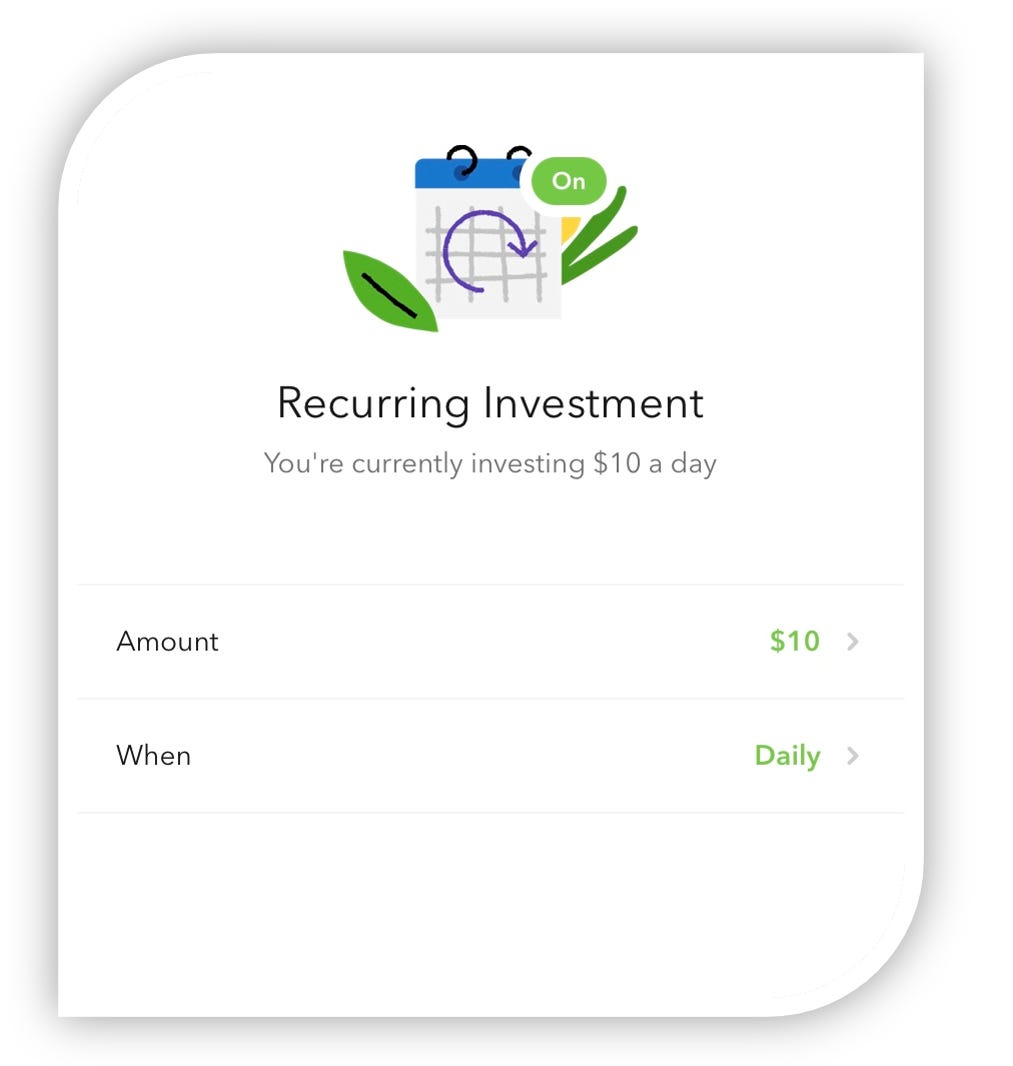

This is another option for how to simply add money to your account daily, weekly, or monthly. You can go into the Re-Occurring section and select how much you want deposited out of your bank account and on which day.

This is how I use the app. I set up weekly deposits online when I get paid so that money instantly gets put into my Acorns account and invested for me so that I don’t have to remember to deposit money each week.

One-Time Deposit

Maybe you do want a more hands-on approach to your investments. Well, guess what? Acorns will do that for you too. Click the One-Time button and put in as much money as you want.

This feature is great for the people that want to put in specific amounts at specific times and be more in control of their investments. There is no limit to how many times you can make a One-Time Deposit.

Company Partnership Deals

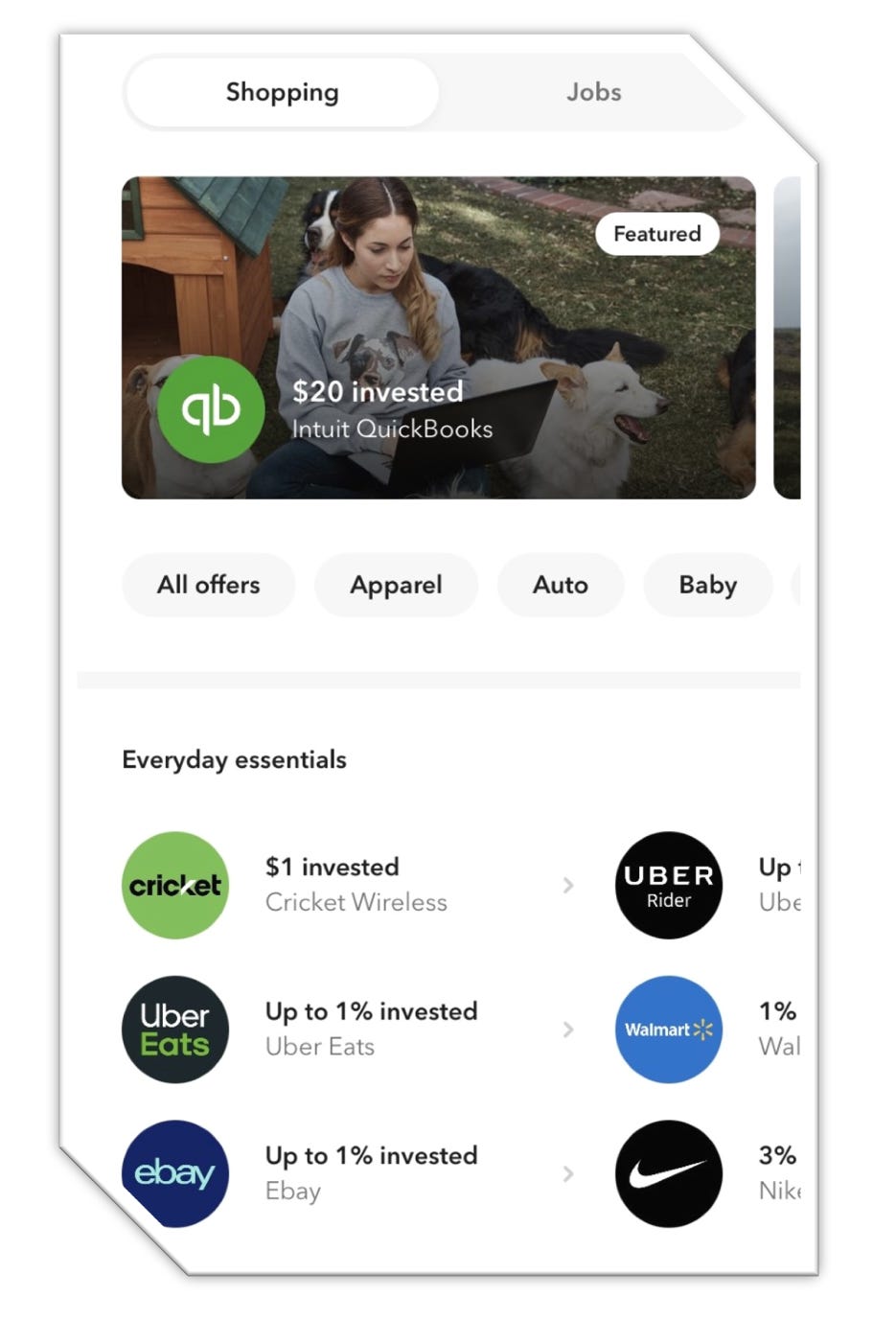

Acorns also has a section where they partner with your favorite companies (UberEats, Nike, Walmart, etc.) and allow you to get free money from other businesses if you shop through Acorns on the company websites.

They will give you a percentage or a hard amount based on how much you spend. Isn’t that sweet? You are spending money to make money!

Cost

So, how much does it cost to have an account and access all these features? Only $3 a month! No, I am not kidding.

Start Investing Today

There is no time like the present and that is the mindset to have when it comes to the stock market. The longer you are in the markets, the more success you could have.

If after reading this article you still do not feel like Acorns is for you, there are a ton of great options out there for you to go check out. So, before investing, make sure you do your research on what works best for your financial goals.

Below is my referral link one more time if you want $5 free deposited into your account after you deposit your first $5!

Hey! I'm using Acorns and I love how easy it is to save and invest for my future. Join me and you'll get a free $5 investment! https://share.acorns.com/griffin.prock?advocate.partner_share_id=1515678658524068496

Featured Newsletters

This week we have another great collaboration with great newsletters! Check them out below and subscribe!

Growth Currency

By: Dylan

Growth Currency is a newsletter by creators, for creators. You’ll get a weekly dose of curated links to things like...

→ helpful tools

→ valuable courses

→ marketing tips

→ actionable resources

→ creator communities

All this to help you go from learning to earning as an online creator. Join over 700 other subscribers already getting Growth Currency in their inbox each week.

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August 2020! We are already up to 364 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.