What Are All Those Numbers Under a Stock Chart?

Time to break down what each of the 9 most common numbers are that appear under a stock chart

Welcome to the 3 new “In-Between‘s” who have joined us since last weekend! Join the 246 others by subscribing here if you haven’t already 📩:

Have you checked out The In-Between Podcast on Apple Podcasts yet? Give it a listen by clicking the button below if you haven’t already 🎙️:

We Have All Seen Them:

We have all researched a stock and seen nine numbers below the stock with funky words next to each of them. For example, look at this image of Apple stock below.

You are in luck because I will be breaking down each of them in this article. It is crucial that you learn what all the categories mean so that you can evaluate a stock correctly. These numbers will help you make smart decisions on things like:

- When to buy/sell

- Value of a stock

- Price to earnings

- Size of company

- Etc.

Let’s dive right into it!

Definitions:

“Open”

This is the best one to start with because it is simple. The open number is the exact price of the stock at the beginning of the day, right when the market opens. Bada bing bada boom. This means that Monday through Friday that number will vary each morning depending on where it ends the previous night.

The stock market opens at 9:30 am and closes at 4:00 pm (Eastern Standard Time). This is for reference when you track what the stock’s price is to start the day.

An important thing to remember is that there is “after hours” trading that takes place which can swing the prices. So, the open might not always be what it closes at the night before.

“High” & “Low”

This is another one of those simpler sets of numbers. As you probably guessed, these two numbers are the highest and lowest prices the stock hits in each period. Usually these are for a single day of trading.

These numbers will give you an idea of how much volatility is in a stock, and how much trading activity happened during that day.

You will probably see this gap be wider on days of big company announcements, earnings reports, or changes in the company.

Check out my article below on what factors determine a stock’s price if you missed it earlier this month!

What Factors Impact a Stock Price

“Mkt cap” or “Market Cap”

These next few numbers get a little more complicated, so stick with me as they are very important when analyzing a stock.

So, what is market cap? Well, first it is short for market capitalization. In short, this is the market’s value of the outstanding shares of the company’s stock. To simplify that, it basically represents how much the company is worth.

The way this number is calculated is by multiplying the number of outstanding shares by the current value of one single share. Outstanding shares means shares that are not owned by anyone yet.

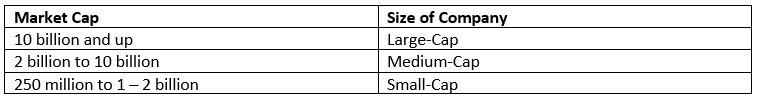

As you probably guessed it, a bigger market cap means a bigger company. Look at Apple as an example, the market cap is 2.44 T at the time of writing this, making it easily a large cap company. The chart below breaks down the various levels of market cap in respect to company size.

“P/E Ratio”

P/E ratio or price to earnings ratio is defined as the formula:

Market value per share / Earnings per share = P/E Ratio

I know that was confusing, so let’s break it down.

Investors use this number as a way of defining the value of a given company. For Apple, as an example, the P/E ratio is 32.85, meaning that Apple is trading at a value of almost 33 times earnings. You can probably put two and two together saying that seems high, and you’d be right. A high P/E ratio either means the stock is overvalued or investors see a lot of growth for the stock in the future.

P/E ratio is a good number to use when determining the value of a stock and when to buy the stock depending on if the market thinks it is overvalued or undervalued. A high or low number does not always correlate to a good or bad buy.

“Div Yield” or “Dividend Yield”

You are probably seeing a trend here that all of these are some sort of formula. Well, this one is also a formula that changes as the company changes. First, however, we need to define what a dividend is. A dividend is the amount a company pays out quarterly to its shareholders. Breaking it down even further, it means that if you own stock in a company that gives out a dividend, you will be rewarded by getting free money back each quarter.

A dividend yield is the dividend divided by the price of the stock. That was a mouth full, I know. Here is a great breakdown from The Balance that will help you understand the formula better!

The dividend statistic under each stock is very important to look over when investing.

“Prev Close” or “Previous Close”

This number is self-explanatory as it is in the name. The previous close is whatever the stock’s price was when the markets closed trading on the previous day. This will usually be like the open number but will vary because of after hour market moves that take place.

For long term investors this number does not mean much. For “day traders,” though, it is very important to know where the stock ended the day before to accurately forecast future days.

You should use this number to see how much price action took place the previous day. A larger gap between the closing number and the current number means that a lot of trading action happened on that stock.

“52 wk high” / “52 wk low”

I hope we all know that a year has 52 weeks. That means these two numbers are tracking the data of the highest and lowest points the stock hit each year.

Over the past 52 weeks Apple has hit $150.00 per one share at its highest and $81.14 per one share at its lowest.

These numbers show us how much a stock has gained or lost over the past year, but really does not tell the whole story. It does not give you insights as to why it moved the way it did. This is why you need to not only use these numbers, but make sure you are looking at all the factors before investing in a stock.

It all makes sense now!

Doesn’t it??

I know a lot of us have probably looked at those numbers and just thought about how they were something you probably would never figure out because they were way to complicated. Well, cheers to learning them together in this article!

Reference this article any time you are researching stocks and need a refresher on what these numbers represent.

Also, check out previous articles I have written on other stock topics below!

Time to Breakdown Different Stock Types

How to Start Investing - From the Very Beginning

How to Apply Diversification to Your Portfolio

Cheers!

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August! We are already up to 246 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.