What Returns Can I Expect When I Begin Investing?

You will find many ideas out there, but history gives us the correct answer

Someone Always Offers More

We have all seen an advertisement claiming you can make 1% returns every single day of investing. Or maybe your friend has told you that they have seen an annual return of 25% - 50% in their investment portfolios.

Unfortunately, those two scenarios are both impossible and/or are not over a long enough time frame to have much merit. Yes, there are people that get very lucky in the markets and can see returns like that, but over more time they will see far less returns or even annual losses as it is not sustainable to keep such growth.

Just think about it, that person making 1% every day would be a billionaire in a very short amount of time. You don’t know many billionaires, though, do you?

I am writing this introduction to not only warn you about potential scams out there, but to also ease any stress you have if your investment portfolios are not pulling the same rate as your “friends’” portfolios are. Investing is not a quick and easy process. Be prepared to let that money sit in the market for years before seeing the growth you want. You must have patience, young grasshopper.

Let us dive into what is reasonable to expect – and why – when it comes to average yearly returns!

Average Stock Market Return

The true answer to our original question of, ‘what returns can I expect to see?’ is about 8% - 12% annually. Let me give you an example so everyone can see that number in dollar terms:

$1,000 Investment à 8% = $1,080 after a year

$1,000 Investment à 12% = $1,120 after a year

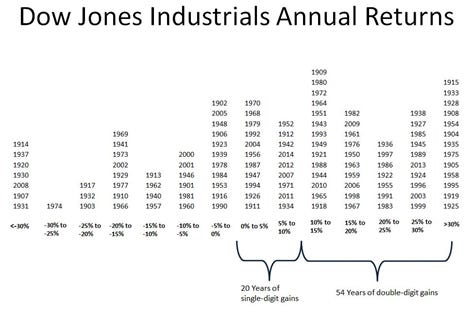

The graph below shows the breakdown of all the different yearly returns for the Dow Jones throughout its entire history. This is how 8% - 12% came to be the industry standard in terms of investment returns.

What to Do with This Information

As you might see on this chart, there are many years having single and sometimes double digits losses. Before you tell me, this makes you skeptical and wary of the market and its never-ending ups and downs and unknowns, I hear you. This is the biggest hesitation people have when it comes to investing, especially since we have had some years of large falls.

Never fear, I am here to remind everyone that investing is and should be a long-term game, not short-term. I am talking decades long if you are using investing as a way to combat inflation in your savings account. Which, by the way, is not a bad idea.

I also have some statistics for you to help calm your nerves about playing the long game. If you hold your money in the market for multiple decades, your likelihood of having a positive return on your money is in the 90% and up range. This means when you start investing, always think long-term and do not let low months or even years deter you from investing in your future!

What to Avoid

This section is plain and simple. Like I said at the beginning, you will have friends who will brag about huge returns or having a system that is better than just a passive investing approach. Be wary of those people since they probably have not been investing for enough time and/or are using some “scammy” program.

Not even this article is financial advice, you should never take financial advice from any one of your random friends. I am trying to help explain the market and the way it works, but not tell you what to do with it or your money.

There are so many great resources out there that will help teach you how to invest properly for your goals. Go check them out for some real advice and I hope you have a great investing journey!

Short and Sweet

This article is short and sweet as I wanted it to just give you the facts on the percentages you should realistically expect when investing. I could have probably just written this out in a Tweet, but I wanted to give a little more context, and that super cool graph. I will link below all of my other financial articles for you to check out to learn more. Remember, stay calm and try to resist the FOMO when you see others making huge returns so quickly. You have no idea the way that came to be, and now you have information and context to view those scenarios with a more critical eye. Like I said before, patience, young grasshopper.

Cheers!

Other Financial Articles

How to Start Investing - From the Very Beginning: Here

How to Apply Diversification to Your Investing Portfolio: Here

Time to Breakdown Different Stock Types: Here

Cryptocurrency, History, Technology and Bitcoin: Here

Credit: What You Need to Know: Here

Did you know?

You can also listen to The In-Between Newsletter through a podcast? The In-Between Newsletter has also expanded to The In-Between Podcast for an even more detailed breakdown of each weeks articles!

Listen to the Podcast if you haven’t already, and hit the subscribe button as well while you are there! Click the box below to be directed to Apple Podcasts!

The In-Between Instagram Page

Go check out the brand new In-Between Newsletter Instagram page to help support the newsletter further:

Click here: The In-Between Newsletter Instagram Page

Follow, Like, Comment, and Share the page with your friends! Let’s get to 200 followers!

You Should Definitely Share: The In-Between Newsletter

This newsletter has been growing so much since I started it in August! We are already up to 210 subscribers. Let’s keep the momentum going!

I want this newsletter to be for anyone, all ages, and all backgrounds.

Like I said above, I feel like the public school system does not always teach us some of the most important information we need to be ready for the real world. And so, The In-Between Newsletter was born. I write about topics ranging from career, finances, personal development, and everything else in between that I think everyone would benefit from.

So, if you know anyone that would benefit from a weekly newsletter written by a great, humorous, overall exceptional writer, then share the link and just put in an email!

I appreciate all the endless support and look forward to growing this thing even bigger.