What is Your Net Worth? Time to Crunch the Numbers

Defining your net worth will help you take your next financial step

Welcome to the 6 new “In-Between‘s” who have joined us since last time! Join the 531 others by subscribing here if you haven’t already 📩:

Where I Have Been

I know, I know, many of you have probably been wondering why your favorite newsletter has been MIA for the past month or so. Well, this summer has been the best time of my life. I got married! Some of you know I have been engaged for the past year to my best friend and the amazing CEO (Chief Editing Officer) of this newsletter, Maddie, who has also made some guest appearances on The In-Between Podcast. We got married on July 17th at Roche Harbor Resort on the San Juan Island, and we could not have asked for a more beautiful day. Cheers to being newlyweds!

Not only did I get married, but that then included an amazing honeymoon to NYC, and reentering work after time off for wedding festivities. So, you could say I have been a little busy, LOL.

That being said, I have missed writing and am excited to jump back into it!

Net Worth – Defined

There is a basic formula that can be used to calculate one’s net worth. Yes, it is that easy. Any time you are curious what you are worth, use this formula to calculate it:

Total Assets – Total Liabilities = Net Worth

Super simple, right? Well, now we need to define what exactly an asset is and what a liability is. This will determine how your formula is going to look.

The “awesome” asset

Everyone loves a good asset. You know why? It is something valuable that you own. That is the simplest definition of an asset. Listed below are a few examples of assets you may have:

Cash

Investments (stocks, bonds, cryptos, etc.)

Accounts (checking/savings accounts/401K, etc.)

Real estate or land

Collectible item/possession

The “not-so-awesome” liability

The asset calculation was probably fun, but the liability section might not be. The good thing, however, about this exercise is you will be able to dive into what might be holding you back on your financial goals so that you can manage your finances better! Here are some examples of liabilities you might have:

Student Loans

Car Loan

Credit Card bills (maybe multiple)

Debts of any kind

Mortgage on a house

Now that you have listed out all your assets and liabilities, simply fill out and calculate the formula to determine your current net worth.

Your reaction to your net worth may surprise you. Some readers might be feeling happy, sad, confused, or even disappointed. The best way to keep a positive outlook is to dive into the weeds of why your net worth might be where it is.

Breaking Down Your Finances

Your net worth is determined by so many factors, a lot of those factors you have control over. This includes your spending habits, asset allocation, and investment choices. Here is what I do every month to ensure I am staying within my limits to meet my financial goals.

Start an excel sheet and list out a monthly breakdown of what you spend on average on daily life things. I will give you a list to start with: rent, bills, gas/public transportation, groceries, going out, clothes, personal care, memberships, etc.

Do your best to be honest with yourself and list these numbers out as high as they might be. Then take your annual monthly income and subtract from that number your total monthly expenses.

Total income – Total expenses = Money left over

That difference right there is the money you have lying around to be saved, spent elsewhere, or even invested.

Re-working your financial habits

Now that you are aware of where your money is going each month, it is time to start practicing better financial habits to reach your goals.

Cut Expenses

What you want to do next is look through where you spend a majority of your money and think of ways you can cut out some of those expenses. This will help you grow your net worth exponentially month over month because you will be saving that money instead of spending it.

The obvious place to start with is your discretionary spending habits like eating out, shopping, memberships, etc. Are these ringing a bell?

Start Investing

Another way to grow your net worth is to invest. This is the way many people start to build wealth rapidly. Compound interesting is your friend and will work wonders for you if used correctly. I have many articles on investing, so check them out below for more specific info!

The Essential List of 30 Investing Terms - Defined

The Psychology of Stock Market Cycles

What Are All Those Numbers Under a Stock Chart

Understand your debts

When debt is present, the best thing you can do is better understand how to attack it and pay it off. When you are cutting expenses, you can then put a lot of that money towards that debt, so you do not have that hanging over you anymore. I know debt can be hard and take years to pay off in some circumstances, so putting in a plan of action to attack the debt becomes that much more important.

Track Your Progress

Now that you have defined your net worth, you understand assets/liabilities, and are ready to re-work your financial habits, it is time to track your progress!

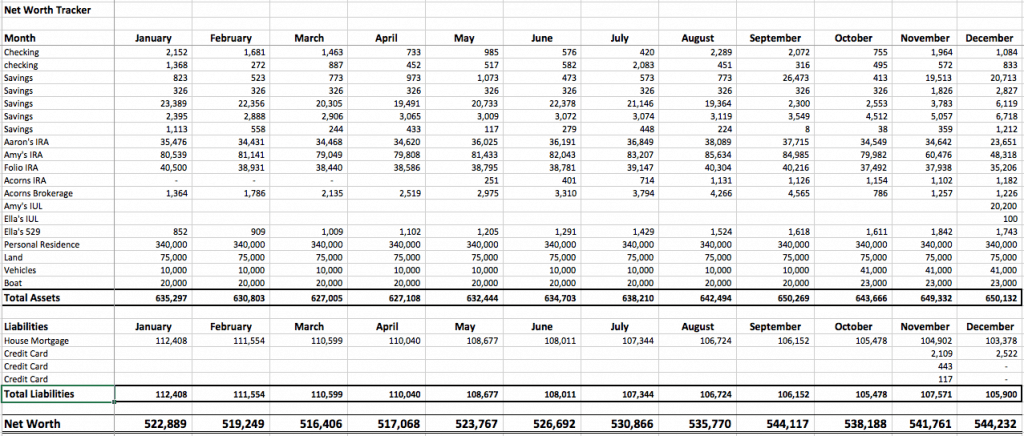

Open an excel document and build out a sheet like the example below 👇

On the first of every month, open that document and input the amounts each of your assets and liabilities are currently. Perform the calculation and you will get your net worth at the start of every month.

As you go through the months, re-evaluate your expenses, investments, and overall financial choices to keep you on the track of raising your net worth.

Control the parts of your finances that you can control, and you will start making the progress you have always been seeking.

It feels good to be back. Cheers!